How to calculate cost of borrowing

One Form Multiple Offers. 3 1 For the purpose of section 451 of the Act the cost of borrowing for.

Self Employment Income Statement Template Unique Example Format In E Statement Template Free Down Statement Template Profit And Loss Statement Income Statement

Use this calculator to find out how much a loan will really cost you.

. This is just one of over 100 useful topics you can access in your Financial Wellness Center. How APR the cost of borrowing is calculated. To do the cost of borrowing calculation using the discount module the total costs of 2500 is entered into the yellow input box by first.

Borrowing from a 401 k Thinking of taking a loan from your 401 k plan. APR is expressed as a percentage of the original amount borrowed the. With a 30-year fixed-rate loan your monthly.

The answer is 1392. Use this calculator to estimate interest deductions and cost of. The amount you want to borrow.

There are plenty of factors that come into play when calculating the cost of borrowing. Want to Learn More. 48 months at 699 cost of borrowing 63800.

Get The Money You Need. How to use our calculator. Compare Get Personal Loans Here.

Interest accrued A - P 2200 - 2000 and interest 200. Calculate the eligible borrowing cost that will be capitalized as part of the cost of the office building and the finance cost that should be reported in profit or loss for the year. Use this calculator to estimate interest deductions and cost of borrowing savings.

To get started log in to your account and select the Financial. Personal Loans 2022 Low Interest Top Lenders Comparison Free Online Offers. The cost of funds is basically the banks own interest rate for using their customers money.

APR Annual Percentage Rate APR shows the total amount a debt would cost if you borrowed the money for one year. Enter the amount into the box. Answer 1 of 3.

Using the APR formula fees interest 200 200 400. This calculator will compute the effective interest rate of a mortgage when upfront loan costs are included. For example if the lender assesses a fee of 5 and the loan amount is 250000 the fee will be 12500 and you will receive 237500.

The frequency of repayments for. The new AIR or the new EIR are often called the TOTAL COST of BORROWING or THE COST OF BORROWING. The cost of borrowing varies depending on the type of loan you take out so its important to ask.

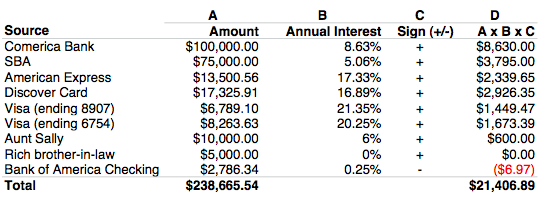

W4 Weighted Average Borrowing Cost Rate. Working out the true cost of borrowing means taking into account. Calculate the eligible borrowing cost that will be capitalized as part of the cost of the office building and the finance cost that should be reported in profit or loss for the year ended 31 December 2013.

Use the slider to set the. If APR were a puzzle it would have many pieces. Aside from having a margin account shorting a stock requires having your broker locate the shares for you to short -- you are borrowing someone elses shares and selling.

When determining the total cost of the loan you need to know the amount you are borrowing the interest rate and how long it will take to repay the loan. You need to check with the local state. This will show you how the interest rate affects.

You must however pay back 250000 to the lender. Advertisement Step 1 Format your. Next add the interest to the closing cost.

Taking an investment loan min. Ad Need a Personal Loan but Have Bad Credit. Choose how much you want to save or borrow.

The frequency of repayments for. The cost of any fees you might have to pay. Before you do you should check out the true costs of such a loan with this calculator.

Ad Low Interest Loans. This equation should help understand how cost of funds is calculated. The new AIR is 1392 and the corresponding EIR is 1484 The new AIR or the new EIR are often called the TOTAL COST of BORROWING or THE COST OF BORROWING.

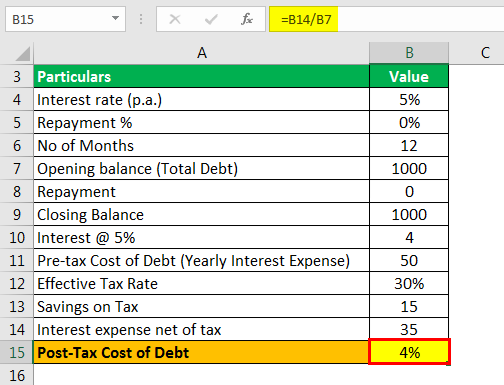

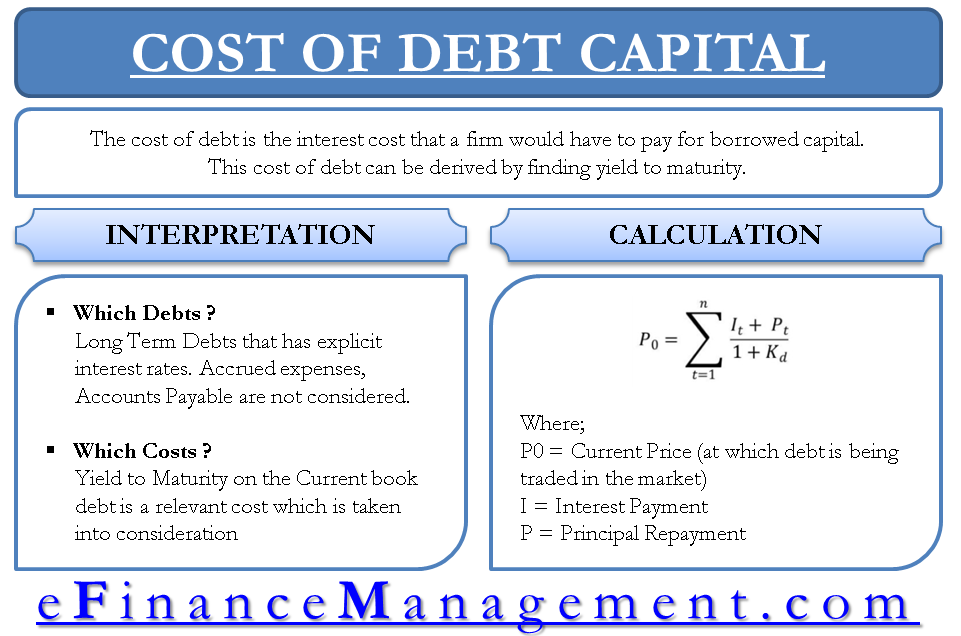

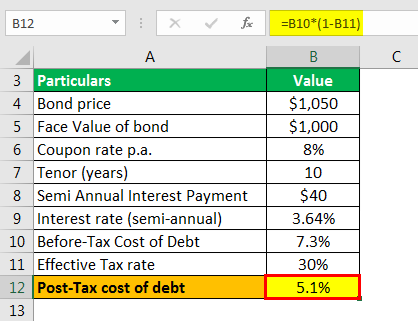

Cost Of Debt Definition Formula Calculate Cost Of Debt For Wacc

Cost Of Debt Kd Formula And Calculator

Cost Of Debt Kd Formula And Calculator

Understanding Equity Kicker Financial Management Accounting And Finance Equity

Cost Of Debt Should Be Interest Cost On Capital Yield To Maturity Efm

What Is Apr How It S Different From Apy And How To Calculate It Business Insider Money Matters Calculator The Borrowers

Cost Of Debt Kd Formula And Calculator

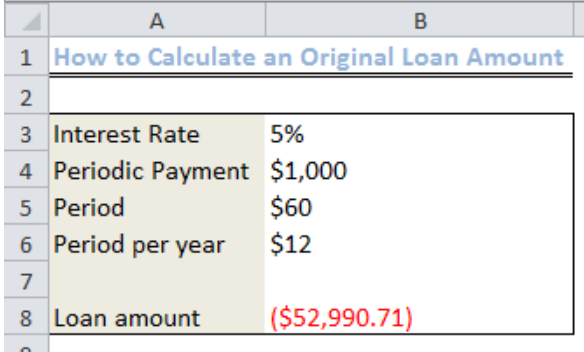

Excel Formula Calculate Original Loan Amount

Models For Calculating Cost Of Equity Accounting Books Equity Accounting And Finance

Excel Formula Calculate Interest Rate For Loan Exceljet

Understand The Total Cost Of Borrowing Wells Fargo

Cost Of Debt Kd Formula And Calculator

Cost Of Debt Definition Formula Calculate Cost Of Debt For Wacc

4 Easy Steps To Calculate The Cost Of Money Ordoro Blog

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Cost Costing Cost Accounting And Cost Accountancy Cost Accounting Accounting Accounting Notes

Cost Of Debt Kd Formula And Calculator