Average percentage taken out of paycheck

QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. The other 3240 is taken.

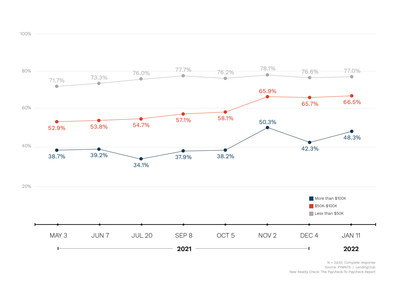

63 Of Americans Have Been Living Paycheck To Paycheck Since Covid Hit

This gives you your take home pay as a percentage of gross pay per pay period.

. These amounts are paid by both employees and employers. The Heart of Dixie has a progressive income tax rate in which the amount of tax withheld depends. Paycheck Tax Calculator Social Security tax and Medicare tax are two federal taxes deducted from your paycheck.

In Tennessee for example only 1806 of your. That comes out to about 156 or 33 percent of your paycheck respectively. If you increase your contributions your paychecks will get smaller.

Every employee is taxed at 62 percent for Social Security and 145 percent for Medicare. You pay into these systems now so you can receive the benefits when you are retired. The most common rate used by 20 of the 24 cities with a local income tax is 1 for residents and 05 for non-residents.

This is divided up so that both employer and employee pay 62 each. Yearly after all the taxes are paid for the take-home paycheck is 21597 in total. These amounts are calculated and deducted from earnings after all pre-tax.

Since income tax rates vary from state to state however the size of that bite will fluctuate depending on where you live. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. This means the total percentage for tax.

The Social Security tax is 62 percent of your total pay. Medicare and Social Security taxes together make up FICA taxes. If you have an employer-sponsored health insurance plan you will have a.

You will be taxed 3 on any earnings between 3000. There is a wage base limit on this tax. 56 percent of Americans got health insurance from their employers in 2017.

The Variables The exact amount of each paycheck directed toward health insurance depends on. Detroit has the highest city rate at 24 for residents and 12 for. For the 2019 tax year the maximum income amount that.

September 6 2019. FICA taxes consist of Social Security and Medicare taxes. You pay 145 of your wages in Medicare.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. In other words for every 100 you earn you actually receive 6760.

Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Alabama has income taxes that range from 2 up to 5 slightly below the national average. What is the percentage that is taken out of a paycheck.

For 2022 employees will pay 62 in Social Security on the. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62.

Also Know how much in taxes is taken out of my paycheck. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income. You pay the tax on only the first 147000 of your.

Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Therefore the total amount of taxes paid annually would be 4403.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Here S How Much Money You Take Home From A 75 000 Salary

2022 Federal State Payroll Tax Rates For Employers

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

48 Percent Of Americans With Annual Incomes Over 100 000 Live Paycheck To Paycheck 9 Percentage Points Higher Than First Reported In June 2021 Lendingclub Corporation

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

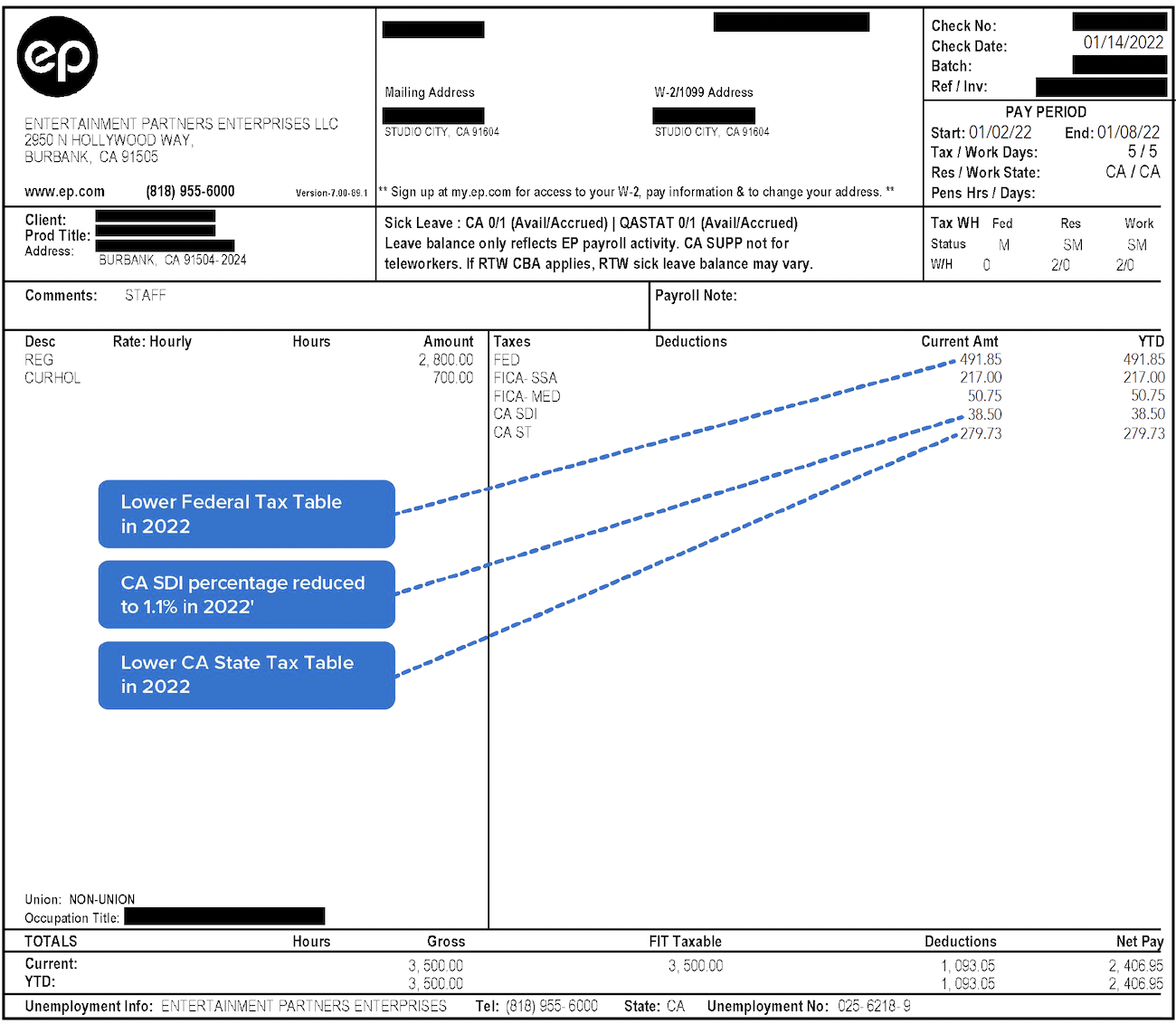

Why Did My Federal Withholding Go Up

Understanding Your Paycheck Credit Com

I Make 800 A Week How Much Will That Be After Taxes Quora

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Living Paycheck To Paycheck

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Living Paycheck To Paycheck

Here S How Much Money You Take Home From A 75 000 Salary

Decoding Your Paystub In 2022 Entertainment Partners

Understanding Your Paycheck

Tennessee Paycheck Calculator Smartasset